Mr Verghese, who is CEO of Olam Agri, said:

“Olam Agri has maintained its outstanding growth track record of delivering operating earnings (EBIT) CAGR6 of 46.7% between 2018 and 2021 with yet another strong performance in H1 2022 as the business continued to capture opportunities from favourable structural growth trends while skilfully navigating supply chain risks and disruptions first from the pandemic and then from the Russian-Ukraine war.

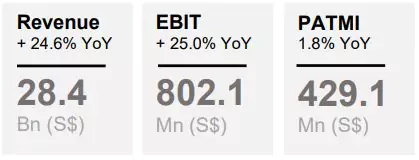

“All three Olam Agri segments – both the Food & Feed segments as well as the Fibre, Agri-industrials & Ag Services segment – grew top-line, bottom-line and margins substantially and was the main contributor to the Group’-s first-half performance. Olam Agri is poised to build on its track record by taking advantage of the rising demand for food staples and agriindustrials raw materials as well as the shift to protein-based diets in high-growth emerging end-consumption markets.

“Its Strategic Supply and Cooperation agreement with its strategic partner SALIC will also catalyse its growth in the Gulf region.

“The reopening of the Ukraine grains shipment corridor is expected to gradually ease future shipments of essential food staples and grains from Ukraine and Russia to improve the current global food security crisis and restore global trade flows.”

Remaining Olam Group

The Remaining Olam Group is responsible for the divestment of non-core assets and businesses (“De-prioritised/Exiting Assets”), nurturing and partially or fully monetising three gestating businesses Olam Palm Gabon, Packaged Foods, and ARISE Ports & Logistics (“Gestating businesses”) and developing Rusmolco, the Russian dairy farming business (“Continuing Business”). It is also responsible for incubating new sustainability and digital platforms for growth (Olam Ventures) and providing IT, digital and shared services to the operating groups as well as to third parties (OTBS).

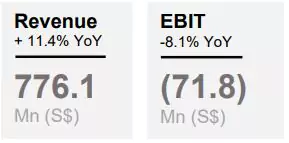

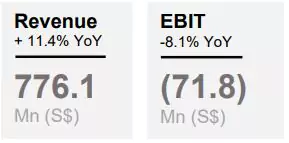

- Revenue was up 11.4%, supported by higher prices that helped to offset lower volumes post divestments and closures of de-prioritised assets.

- EBIT losses increased to S$71.8 million (H1 2021: -S$66.4 million) mainly due to the increase in losses from Continuing/Gestating Businesses.

Outlook and Prospects

The significant demand growth rate and pick-up seen in H2 2021 has slowed down in H1 2022 after the geopolitical crisis, accompanied by the hard pandemic lockdowns in China.

continues to make targeted investments across its portfolio to support its private label thrust and is well-positioned for 2022 as the revised sales pricing and margin recovery gathers pace in H2 2022.

Riding on its strong growth and outperformance in H1 2022, Olam Agri expects to deliver a better year-on-year performance for 2022 while navigating the heightened geopolitical and macroeconomic risks.

In light of the current high commodity price and rising interest rates environment, the Group will continue to focus on managing its working capital in a disciplined manner.

The Group expects to incur additional one-off and non-recurring expenses associated with the Re-organisation Plan in H2 2022 although these expenses for the full year are expected to be lower than the total recorded for 2021.

Overall, given the H1 2022 results and barring any unforeseen circumstances or unfavourable geopolitical, macroeconomic and pandemic developments, the Group is cautiously optimistic about its prospects for the rest of 2022, even as the industry continues to see strong underlying demand amid tight supplies.

6 Compound Annual Growth Rate